Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

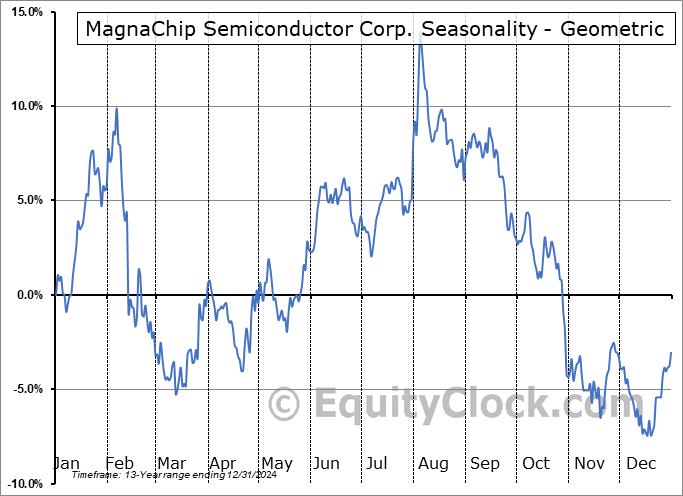

MagnaChip Semiconductor Corp. (NYSE:MX) Seasonal Chart

Seasonal Chart Analysis

Analysis of the MagnaChip Semiconductor Corp. (NYSE:MX) seasonal charts above shows that a Buy Date of May 15 and a Sell Date of August 4 has resulted in a geometric average return of 6.22% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 24.13% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Technology sector, which runs from October 9 to February 15. The seasonal chart for the broad sector is available via the following link: Technology Sector Seasonal Chart.

Magnachip Semiconductor Corp. engages in the design and manufacture of analog and mixed-signal platform solutions for communications, Internet of Things (IoT), consumer, computing, industrial, and automotive applications. Its products include MOSFETs, IGBTs, AC-DC/DC-DC converters, light-emitting diode (LED) drivers, regulators, power management integrated circuits (PMICs), and industrial applications such as power suppliers, e-bikes, photovoltaic inverters, LED lighting, and motor drives. The company was founded on November 26, 2003 and is headquartered in Cheongju-si, South Korea.

To download MX seasonal chart data, please log in or Subscribe.

To download MX seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: MX

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|