Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

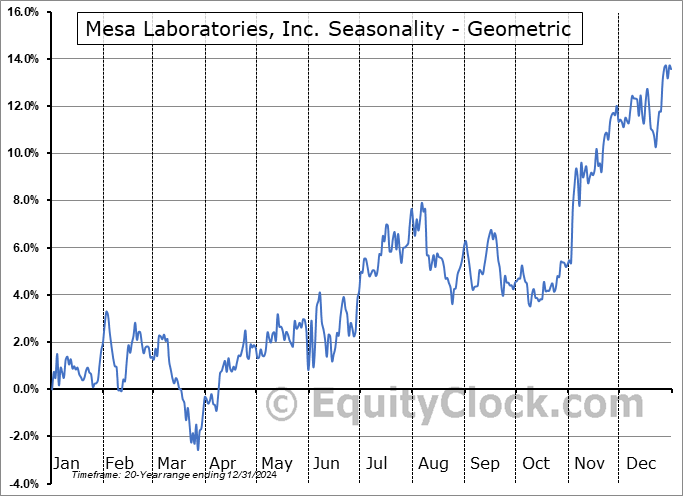

Mesa Laboratories, Inc. (NASD:MLAB) Seasonal Chart

Seasonal Chart Analysis

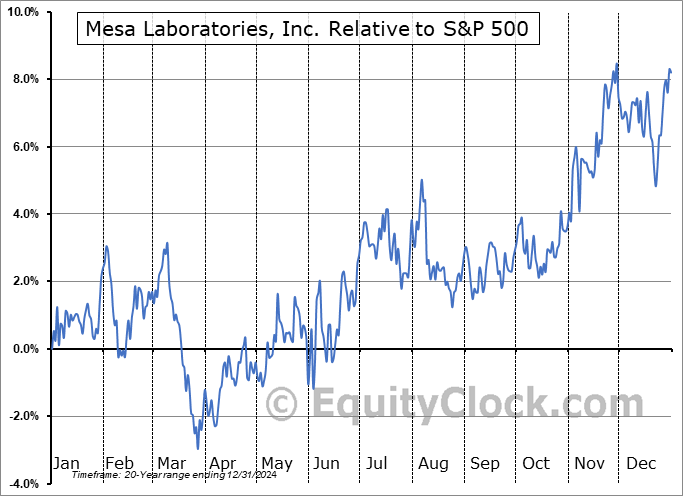

Analysis of the Mesa Laboratories, Inc. (NASD:MLAB) seasonal charts above shows that a Buy Date of September 7 and a Sell Date of February 2 has resulted in a geometric average return of 8.13% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 18 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 9.26% per year.

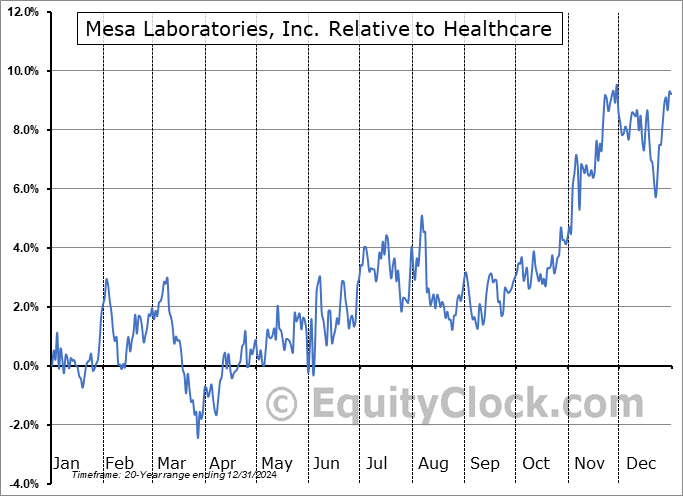

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

Mesa Laboratories, Inc. engages in the design, manufacture, and market of instruments and disposable products utilized in healthcare, pharmaceutical, food and beverage, medical device, and petrochemical industries. It operates through the following segments: Sterilization and Disinfection Control, Clinical Genomics, Biopharmaceutical Development, and Calibration Solutions. The Sterilization and Disinfection Control segment manufactures and sells biological, cleaning, and chemical indicators. The Clinical Genomics segment division develops, manufactures and sells highly sensitive, low-cost, high-throughput genetic analysis tools and related consumables and services that enable clinical research labs and contract research organizations. The Biopharmaceutical Development segment caters and sells automated systems for protein analysis and peptide synthesis solutions. The Calibration Solutions segment focuses on the quality control products using principles of advanced metrology to enable customers to measure and calibrate critical parameters in applications such as renal care, environmental and process monitoring, gas flow, air quality and torque testing, primarily in medical device manufacturing, pharmaceutical manufacturing, laboratory and hospital environments. The company was founded by Luke R. Schmieder on March 26, 1982 and is headquartered in Lakewood, CO.

To download MLAB seasonal chart data, please log in or Subscribe.

To download MLAB seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: MLAB

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|