Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

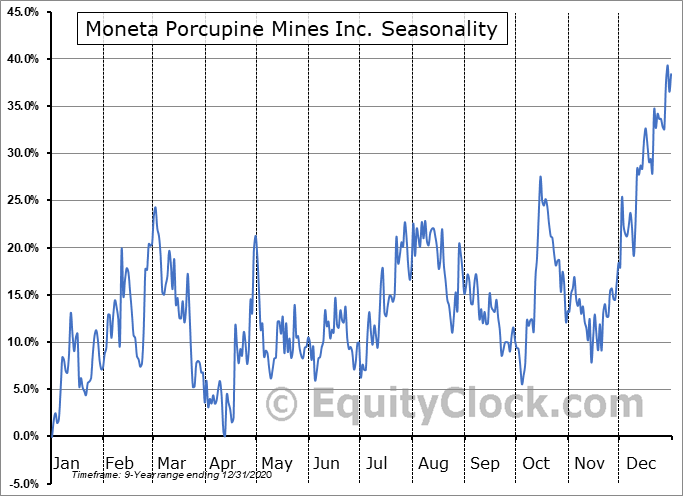

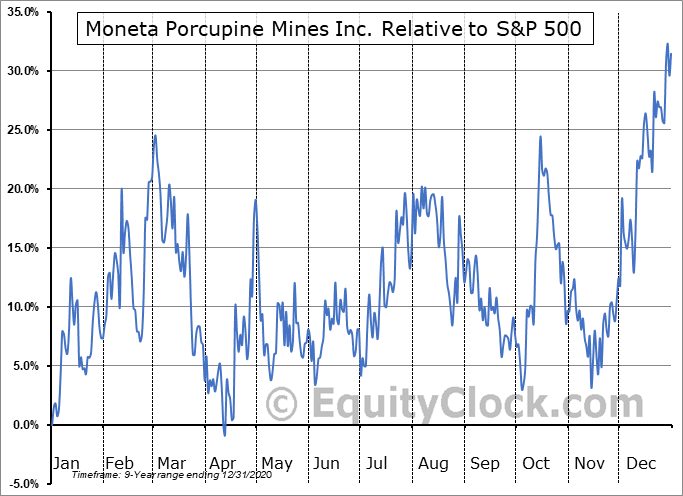

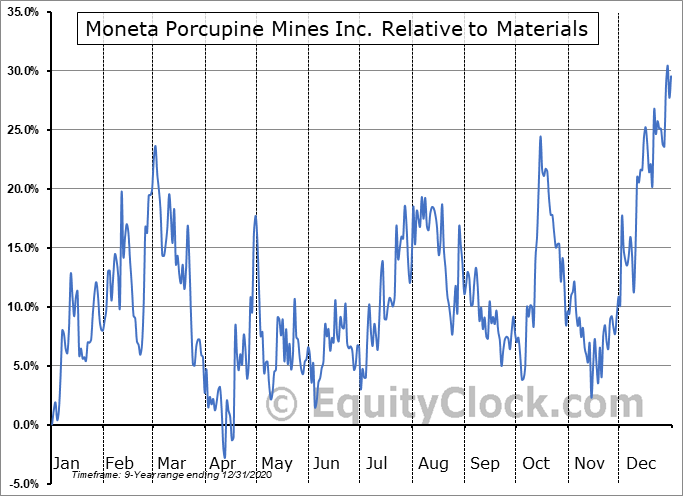

Moneta Porcupine Mines Inc. (OTCMKT:MPUCF) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Moneta Porcupine Mines Inc. (OTCMKT:MPUCF) seasonal charts above shows that a Buy Date of November 17 and a Sell Date of February 12 has resulted in a geometric average return of 17.96% above the benchmark rate of the S&P 500 Total Return Index over the past 9 years. This seasonal timeframe has shown positive results compared to the benchmark in 5 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 9 years by an average of 26.58% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Materials sector, which runs from November 20 to May 5. The seasonal chart for the broad sector is available via the following link: Materials Sector Seasonal Chart.

A word of caution: Only 9 years of data is available for shares of MPUCF, perhaps insufficient to create a seasonal profile that accurately gauges the seasonal tendencies influencing the investment. Ideally, while 20 years is preferred, at least 10 years of data is required to perform a seasonal analysis that is considered to be reliable for future seasonal periods.

Moneta Porcupine Mines Inc holds 100% interest in 6 core gold projects located along the Destor-Porcupine Fault Zone in the Timmins Gold Camp with over 85 million ounces of past gold production. The Golden Highway Project hosts 43-101 mineral resource comprised of 676,900 ounces gold contained within 5.11 Mt @ 4.12g/t Au and a total of 1,386,600 ounces gold contained within 10.78 Mt @4.00 g/t Au in the inferred category at a 2.60 g/t Au at South West and 3.00 g/t Au cut-off for the other deposits. A PEA study completed on the South West Deposit, highlighted an 11-year mine life with an after-tax NPV5% of C$236MM, IRR of 30% and a 3.4 year payback, generating C$371MM LOM after-tax free cash flow. The project envisaged underground mining producing 76,000 oz/pa at a cash cost of US$590/oz.

To download MPUCF seasonal chart data, please log in or Subscribe.

To download MPUCF seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: MPUCF

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|