Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

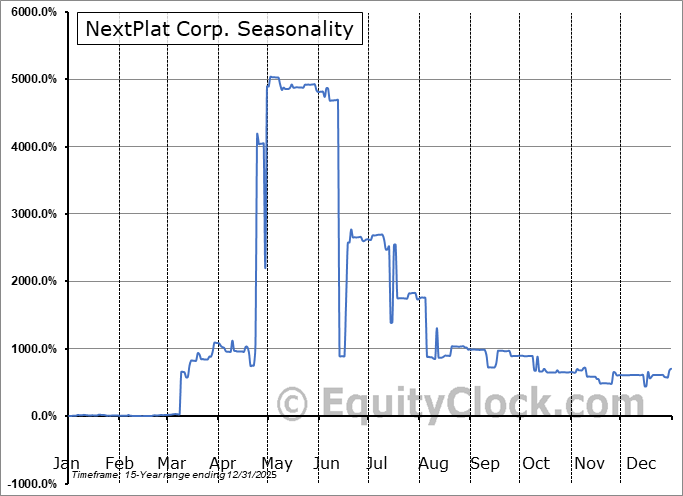

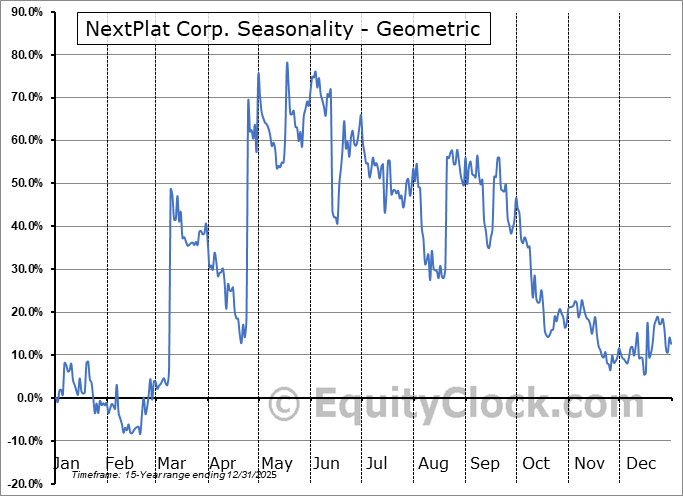

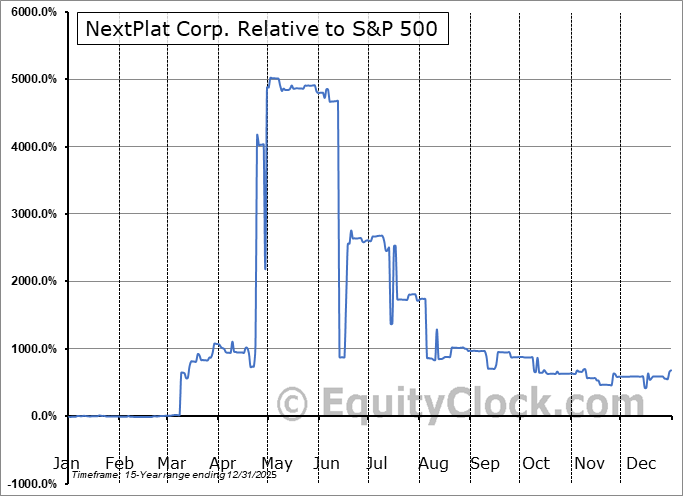

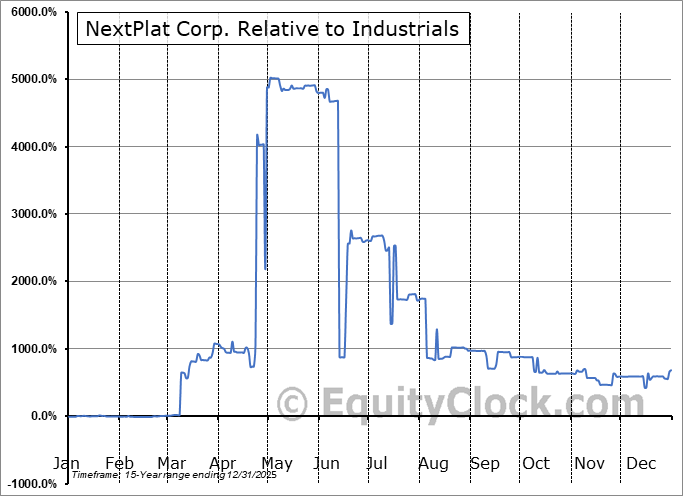

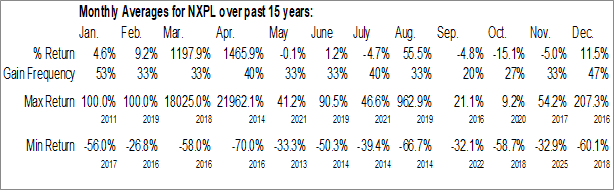

NextPlat Corp. (NASD:NXPL) Seasonal Chart

Seasonal Chart Analysis

Analysis of the NextPlat Corp. (NASD:NXPL) seasonal charts above shows that a Buy Date of December 15 and a Sell Date of March 13 has resulted in a geometric average return of 67.5% above the benchmark rate of the S&P 500 Total Return Index over the past 15 years. This seasonal timeframe has shown positive results compared to the benchmark in 11 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 15 years by an average of 70.46% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

NextPlat Corp. engages in the provision of satellite-based services and solutions for commercial, government and individual users. The firm s services include satellite communication solutions, emergency location systems, high-speed satellite internet and global asset and personnel monitoring, customized ground station systems and custom product design. It operates through the e-Commerce Operations and Healthcare Operations segments. The e-Commerce Operations segment refers to acquiring and leasing, primarily an e-commerce platform to collaborate with businesses to optimize their ability to sell their goods online, domestically, and internationally. The Healthcare Operations segment refers TPA, data management, COVID-19 related diagnostics and vaccinations, prescription pharmaceuticals, compounded medications, tele pharmacy services, anti-retroviral medications, and medication therapy management. The company was founded in 1997 and is headquartered in Hallandale Beach, FL.

To download NXPL seasonal chart data, please log in or Subscribe.

To download NXPL seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: NXPL

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|