Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

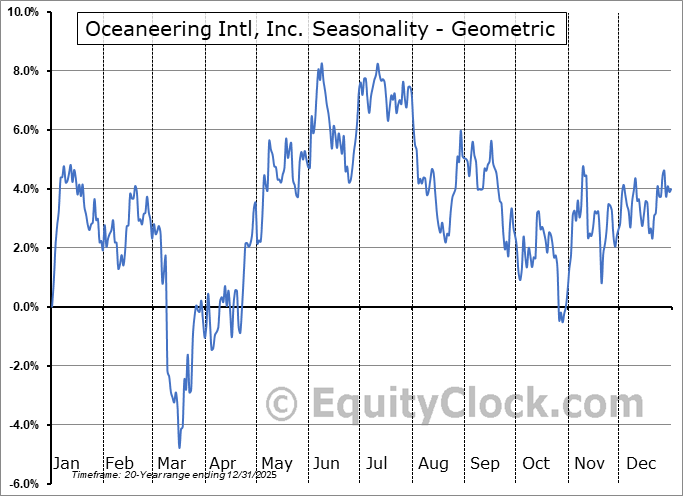

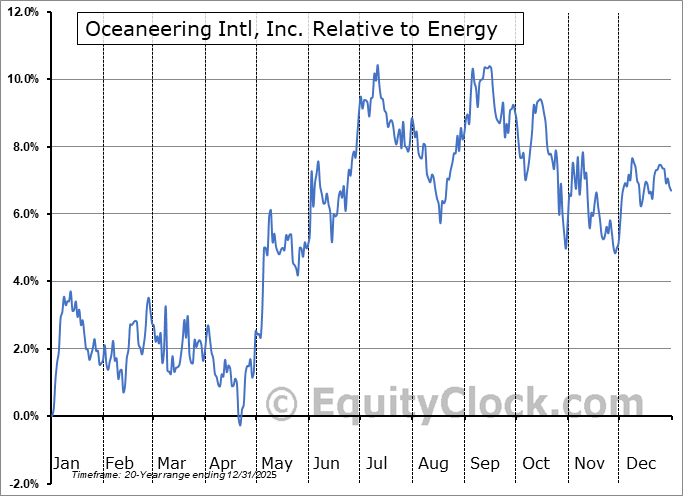

Oceaneering Intl, Inc. (NYSE:OII) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Oceaneering Intl, Inc. (NYSE:OII) seasonal charts above shows that a Buy Date of December 14 and a Sell Date of April 30 has resulted in a geometric average return of 0.63% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 7.04% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Energy sector, which runs from January 21 to May 9. The seasonal chart for the broad sector is available via the following link: Energy Sector Seasonal Chart.

Oceaneering International, Inc. engages in the provision of engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries. It operates through the following business segments: Subsea Robotics, Manufactured Products, Offshore Projects Group (OPG), Integrity Management & Digital Solutions (IMDS), and Aerospace and Defense Technologies (ADTech). The Subsea Robotics segment includes remotely operated vehicles, survey services, and ROV tooling businesses. The Manufactured Products segment provides distribution systems, such as production control umbilicals and connection systems made up of specialty subsea hardware, and provides turnkey solutions that include project management, engineering design, fabrication/assembly, and installation of autonomous mobile robotic technology to industrial, manufacturing, healthcare, warehousing, and commercial theme park markets. The OPG segment focuses on subsea project capabilities and solutions. The IMDS segment covers asset integrity management, corrosion management, inspection, and nondestructive testing services. The ADTech segment provides government services and products, including engineering related manufacturing in defense and space exploration activities. The company was founded in 1969 and is headquartered in Houston, TX.

To download OII seasonal chart data, please log in or Subscribe.

To download OII seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: OII

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|