Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

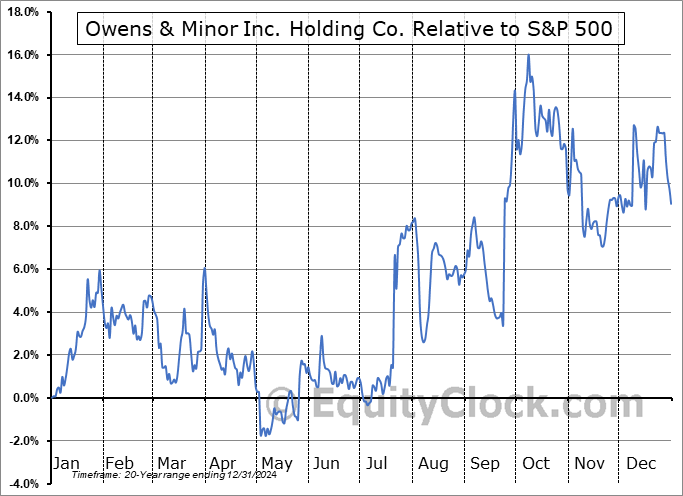

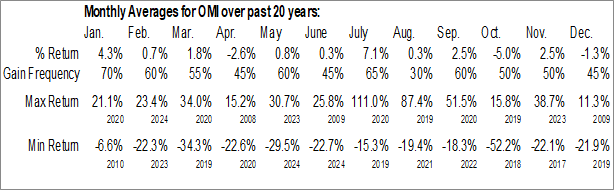

Owens & Minor Inc. Holding Co. (NYSE:OMI) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Owens & Minor Inc. Holding Co. (NYSE:OMI) seasonal charts above shows that a Buy Date of January 9 and a Sell Date of March 31 has resulted in a geometric average return of 2.43% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 11.59% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

Owens & Minor Inc distributes consumable medical supplies to a variety of providers. The business is under two segments: Products & Healthcare Services and Patient Direct. The Products & Healthcare Services segment manufactures and sources medical surgical products through its production and kitting operations and provides medical supplies and solutions for the prevention of healthcare-associated infections across the acute and alternate site channels. The Patient Direct segment provides delivery of disposable medical supplies sold directly to patients and home health agencies. Majority of the revenue is generated from Products & Healthcare Services segment.

To download OMI seasonal chart data, please log in or Subscribe.

To download OMI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: OMI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|