Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

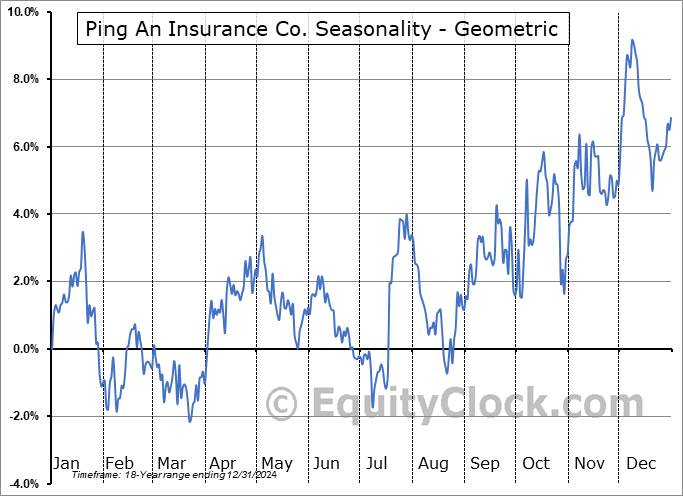

Ping An Insurance Co. (OTCMKT:PNGAY) Seasonal Chart

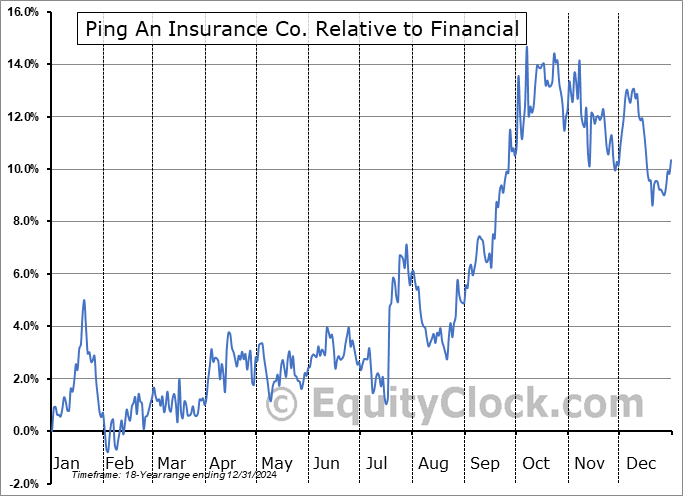

Seasonal Chart Analysis

Analysis of the Ping An Insurance Co. (OTCMKT:PNGAY) seasonal charts above shows that a Buy Date of August 24 and a Sell Date of December 8 has resulted in a geometric average return of 5.92% above the benchmark rate of the S&P 500 Total Return Index over the past 19 years. This seasonal timeframe has shown positive results compared to the benchmark in 15 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 19 years by an average of 7.58% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Financial sector, which runs from November 22 to April 13. The seasonal chart for the broad sector is available via the following link: Financial Sector Seasonal Chart.

Ping An Insurance (Group) Co. of China Ltd. engages in the provision of financial products and services. It also engages in life insurance, property and casualty insurance, trust, securities, banking, and other businesses. It operates through the following segments: Life and Health Insurance, Property and Casualty Insurance, Banking, Trust, Securities, Other Asset Management, and Technology Business. The Life and Health Insurance segment offers life insurance products, including term, whole-life, endowment, annuity, investment-linked, universal life and health care and medical insurance, reflecting performance summary of life insurance, annuity assurance, and health insurance subsidiaries. The Property and Casualty Insurance segment provides insurance products including auto insurance, non-auto insurance, accident and health insurance, reflecting performance of property and casualty insurance subsidiary. The Banking segment undertakes loan and intermediary business, wealth management, and credit card services. The Trust segment provides trust services and undertakes investing activities. The Securities segment undertakes brokerage, trading, investment banking and asset management services. The Other Asset Management segment provides investment management services and financial leasing business, reflecting performance of asset management and financial leasing and the other asset management subsidiaries. The Technology Business segment provides financial and daily-life services through internet platforms such as financial transaction information service platform, health care service platform, reflecting performance summary of the technology business subsidiaries, associates and jointly controlled entities. The company was founded by Ming Zhe Ma on May 27, 1988 and is headquartered in Shenzhen, China.

To download PNGAY seasonal chart data, please log in or Subscribe.

To download PNGAY seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: PNGAY

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|