Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

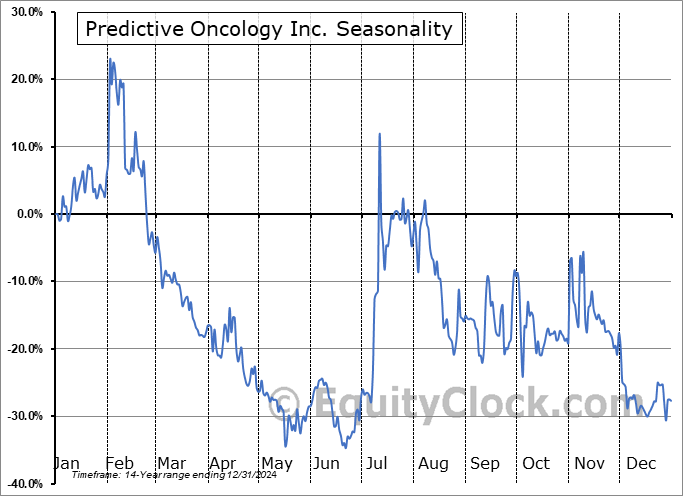

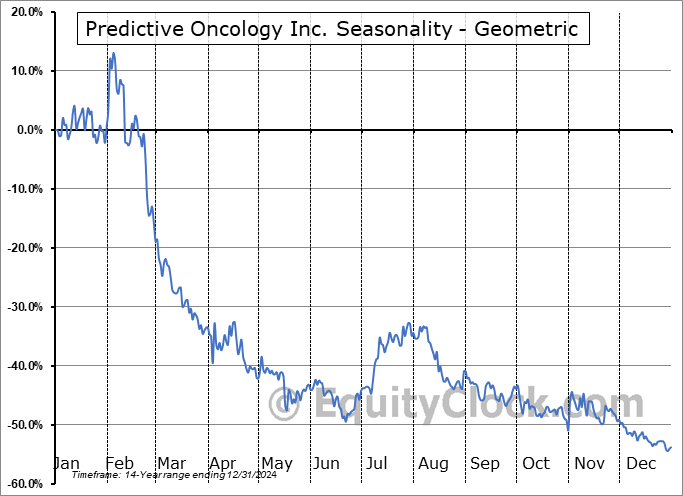

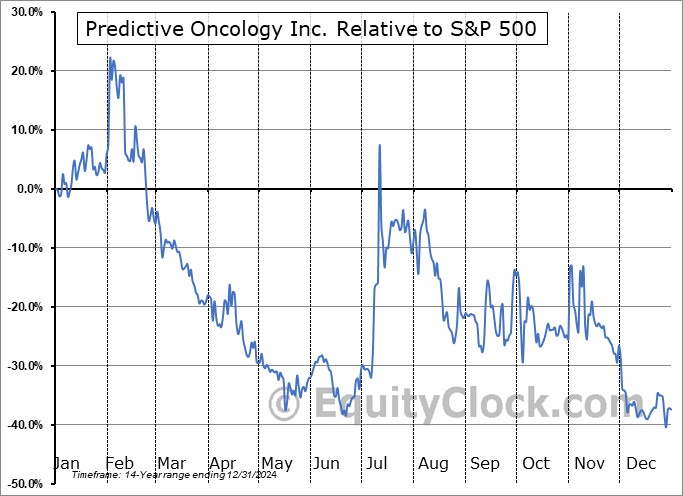

Predictive Oncology Inc. (NASD:POAI) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Predictive Oncology Inc. (NASD:POAI) seasonal charts above shows that a Buy Date of May 16 and a Sell Date of August 4 has resulted in a geometric average return of 20.63% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 10 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 120.63% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

Predictive Oncology Inc functions in the healthcare domain. The firm’s reportable segments are Pittsburgh segment that provides services which include the application of AI using its proprietary biobank of 150,000+ tumor samples. It also creates proprietary 3D culture models used in drug development; Birmingham segment that provides contract services and research focused on solubility improvements, stability studies, and protein production; and Eagan segment that produces the FDA-cleared STREAMWAY System and associated products for automated medical fluid waste management and patient-to-drain medical fluid disposal. It derives maximum revenue from Eagan Segment.

To download POAI seasonal chart data, please log in or Subscribe.

To download POAI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: POAI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|