Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

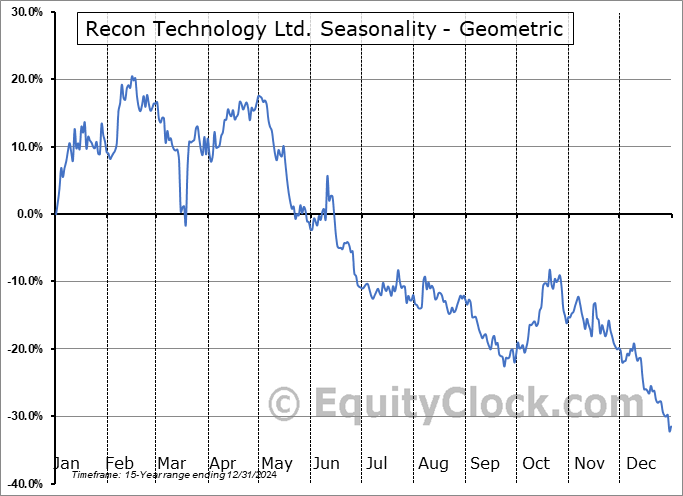

Recon Technology Ltd. (NASD:RCON) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Recon Technology Ltd. (NASD:RCON) seasonal charts above shows that a Buy Date of March 18 and a Sell Date of June 11 has resulted in a geometric average return of 2.15% above the benchmark rate of the S&P 500 Total Return Index over the past 16 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 16 years by an average of 41.92% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Energy sector, which runs from January 21 to May 9. The seasonal chart for the broad sector is available via the following link: Energy Sector Seasonal Chart.

Recon Technology Ltd. engages in providing oilfield services. It operates through the following segments: Automation Product and Software, Equipment and Accessories, Oilfield Environmental Protection, and Platform Outsourcing Services. The Automation Product and Software segment is involved in the sale of automation products specialized equipment when combined with services represent a single performance obligation for the development and construction of a single asset. The Equipment and Accessories segment includes the delivery of standard or customized products and equipment, including automation products, furnaces, and related accessories. The Oilfield Environmental Protection segment focuses on the wastewater treatment products and related service to oilfield and chemical industry companies. The Platform Outsourcing Services segment refers to online platform development, maintenance, and operation services to gas stations around different provinces in China. The company was founded by Guang Qiang Chen, Hong Qi Li, and Shen Ping Yin on August 21, 2007 and is headquartered in Beijing, China.

To download RCON seasonal chart data, please log in or Subscribe.

To download RCON seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: RCON

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|