Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

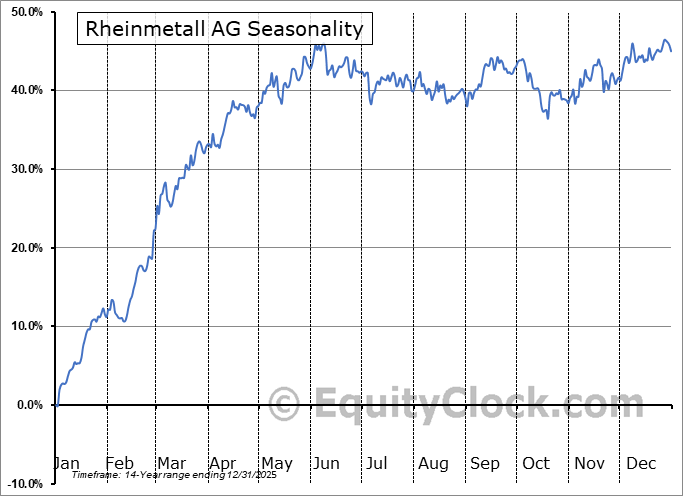

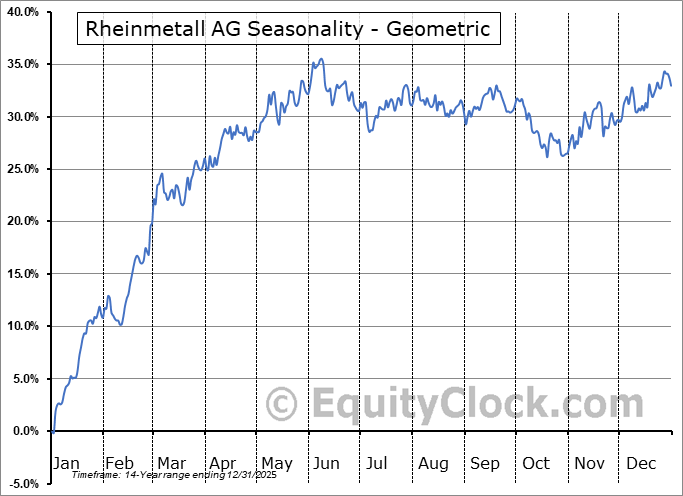

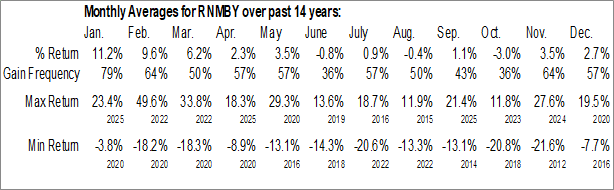

Rheinmetall AG (OTCMKT:RNMBY) Seasonal Chart

Seasonal Chart Analysis

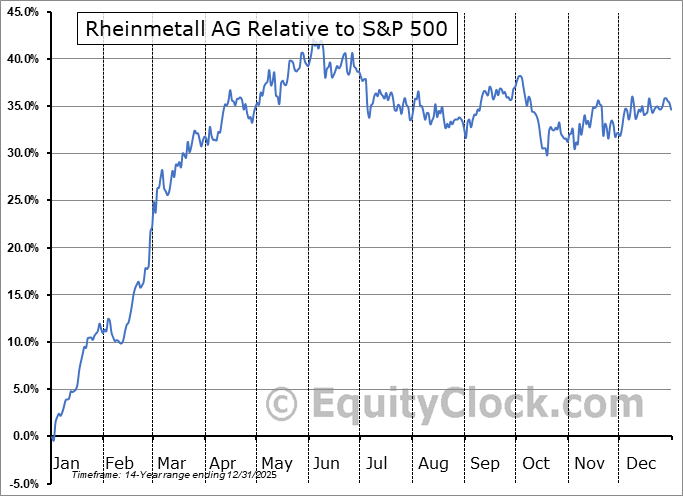

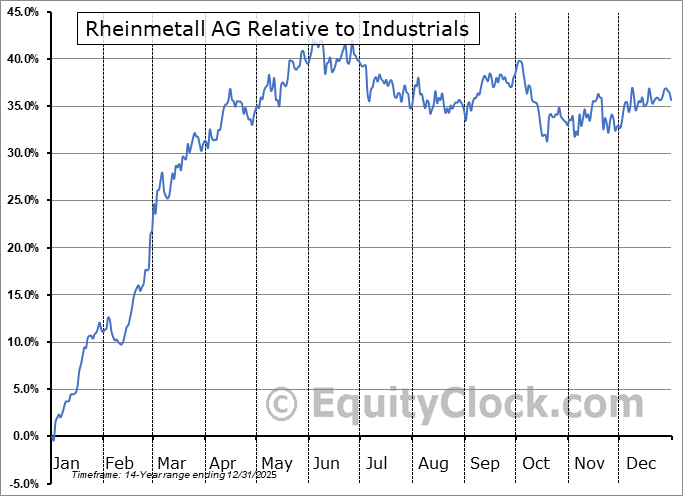

Analysis of the Rheinmetall AG (OTCMKT:RNMBY) seasonal charts above shows that a Buy Date of December 13 and a Sell Date of March 16 has resulted in a geometric average return of 23.48% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 13 of those periods. This is an excellent rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 7.83% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Rheinmetall AG is a holding company, which engages in the provision of development and sale of components, systems, and services for the security and civil industries. It operates through the following segments: Vehicle Systems, Weapon and Ammunition, Electronic Solutions, Sensors and Actuators, Materials and Trade, and Others. The Vehicle Systems segment offers a diverse portfolio of vehicles, including combat, support, logistics, and special vehicles. The Weapon and Ammunition segment includes products and solutions for threat-appropriate, firepower as well as comprehensive protection. The Electronic Solutions segment is involved in the chain of effects in the system network, from sensors and the networking of platforms and soldiers to the automated connection of effectors, as well as solutions for protection in cyberspace. The Sensors and Actuators consists of a product portfolio with exhaust gas recirculation systems, throttle valves, control dampers, and exhaust flaps for electromotors, solenoid valves, actuators and valve train systems, oil, water, and vacuum pumps for passenger cars, commercial vehicles, and light and heavy-duty off-road applications, as well as industrial solutions. The Materials and Trade segment focuses on the development of system components for the basic motor. The company was founded by Heinrich Ehrhardt on April 13, 1889 and is headquartered in Duesseldorf, Germany.

To download RNMBY seasonal chart data, please log in or Subscribe.

To download RNMBY seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: RNMBY

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|