Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

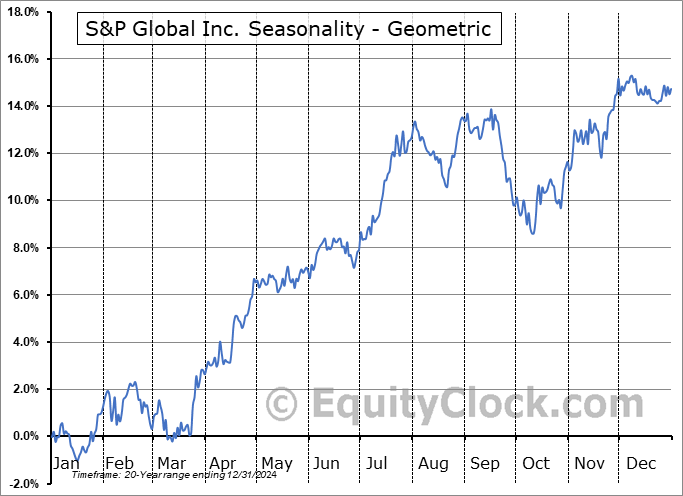

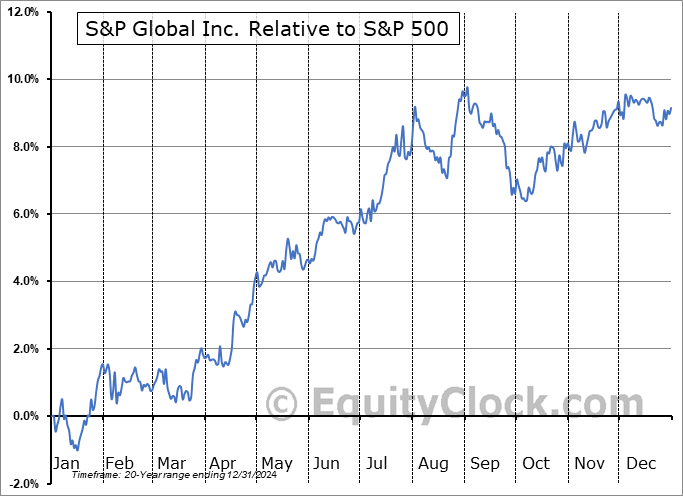

S&P Global Inc. (NYSE:SPGI) Seasonal Chart

Seasonal Chart Analysis

Analysis of the S&P Global Inc. (NYSE:SPGI) seasonal charts above shows that a Buy Date of March 14 and a Sell Date of August 1 has resulted in a geometric average return of 6.51% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 16 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 3.4% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Financial sector, which runs from November 22 to April 13. The seasonal chart for the broad sector is available via the following link: Financial Sector Seasonal Chart.

S&P Global, Inc. engages in the provision of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide. It operates through the following segments: Market Intelligence, Ratings, Commodity Insights, Mobility, Indices, and Engineering Solutions. The Market Intelligence segment provides multi-asset-class data and analytics integrated with purpose-built workflow solutions. The Ratings segment is involved in credit ratings, research, and analytics, offering investors and other market participants information, ratings, and benchmarks. The Commodity Insights segment focuses on information and benchmark prices for the commodity and energy markets. The Mobility segment offers solutions serving the full automotive value chain including vehicle manufacturers, automotive suppliers, mobility service providers, retailers, consumers, and finance and insurance companies. The Engineering Solutions segment engages in advanced knowledge discovery technologies, research tools, and software-based engineering decision engines to advance innovation, maximize productivity, improve quality, and reduce risk. The company was founded by James H. McGraw and John A. Hill in 1917 and is headquartered in New York, NY.

To download SPGI seasonal chart data, please log in or Subscribe.

To download SPGI seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: SPGI

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|