Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

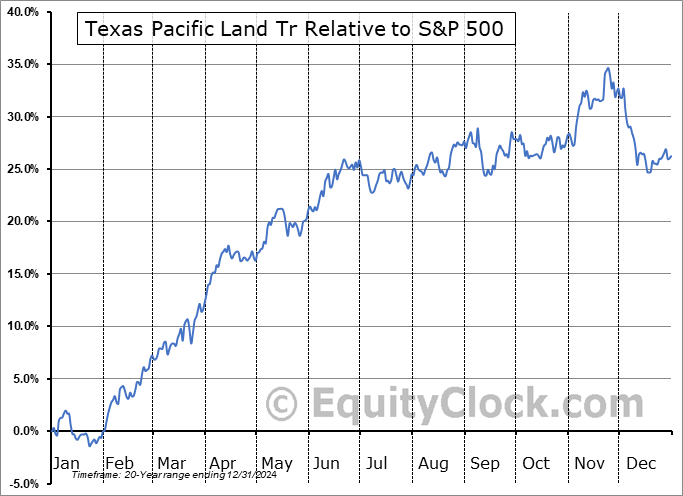

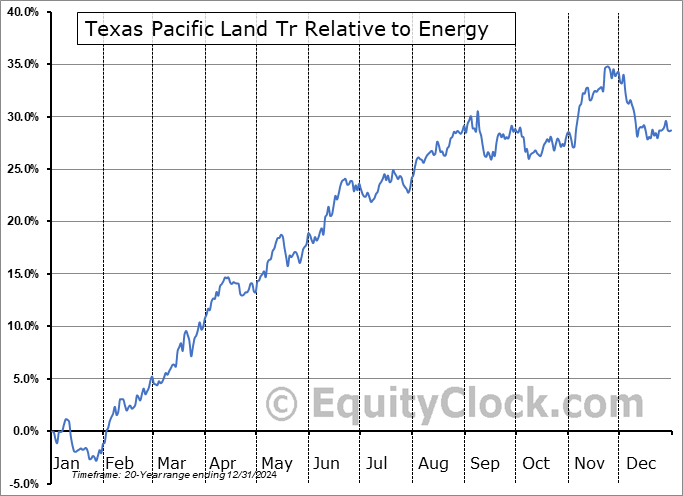

Texas Pacific Land Tr (NYSE:TPL) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Texas Pacific Land Tr (NYSE:TPL) seasonal charts above shows that a Buy Date of March 10 and a Sell Date of July 5 has resulted in a geometric average return of 9.96% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 18 of those periods. This is an excellent rate of success, but the return underperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 4.01% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Energy sector, which runs from January 21 to May 9. The seasonal chart for the broad sector is available via the following link: Energy Sector Seasonal Chart.

Texas Pacific Land Corp. operates as a landowner in the State of Texas. Its surface and royalty ownership allow revenue generation through the entire value chain of oil and gas development, including through fixed fee payments for use of the firm’s land, revenue for sales of materials used in the construction of infrastructure, providing sourced water and treated produced water, revenue from its oil and gas royalty interests, and revenues related to saltwater disposal on land. The firm also generates revenue from pipeline, power line and utility easements, commercial leases, material sales and seismic and temporary permits related to a variety of land uses including midstream infrastructure projects and hydrocarbon processing facilities. It operates through the Land and Resource Management and Water Services and Operations segment. The Land and Resource Management segment focuses on managing oil and gas royalty interest and surface. The Water Services and Operations segment refers to the full-service water offerings to operators in the Permian Basin through Texas Pacific Water Resources LLC, a single member Texas limited liability company owned by the company. The company was founded in 1871 and is headquartered in Dallas, TX.

To download TPL seasonal chart data, please log in or Subscribe.

To download TPL seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: TPL

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|