Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

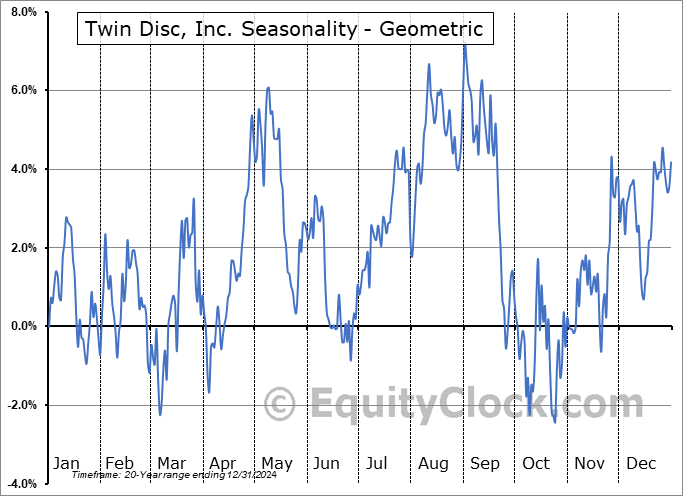

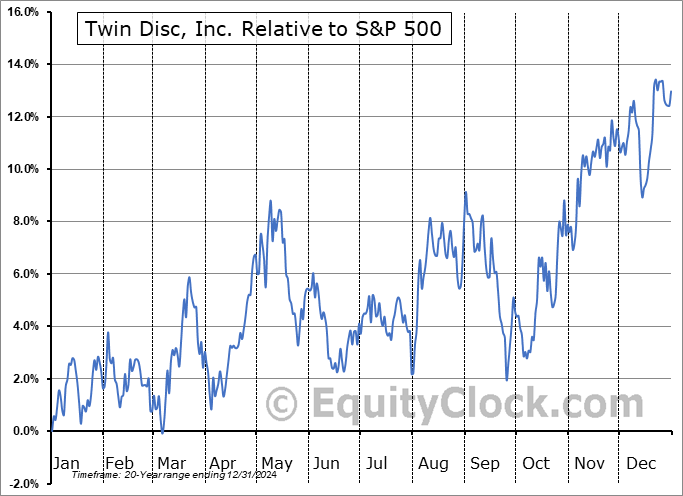

Twin Disc, Inc. (NASD:TWIN) Seasonal Chart

Seasonal Chart Analysis

Analysis of the Twin Disc, Inc. (NASD:TWIN) seasonal charts above shows that a Buy Date of December 17 and a Sell Date of March 22 has resulted in a geometric average return of 2.72% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 14 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 9.95% per year.

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Twin Disc, Inc. engages in the design, manufacturing, and trade of marine and heavy duty off-highway power transmission equipment. It operates through the Manufacturing and Distribution segments. The Manufacturing segment refers to its facilities in Racine, Finland, and Italy. The Distribution segment includes properties in Singapore, China, India, and Japan which are leased and are used for sales offices, warehousing, and light assembly or product service. The company was founded by P.H. Batten in 1918 and is headquartered in Milwaukee, WI.

To download TWIN seasonal chart data, please log in or Subscribe.

To download TWIN seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: TWIN

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|