Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

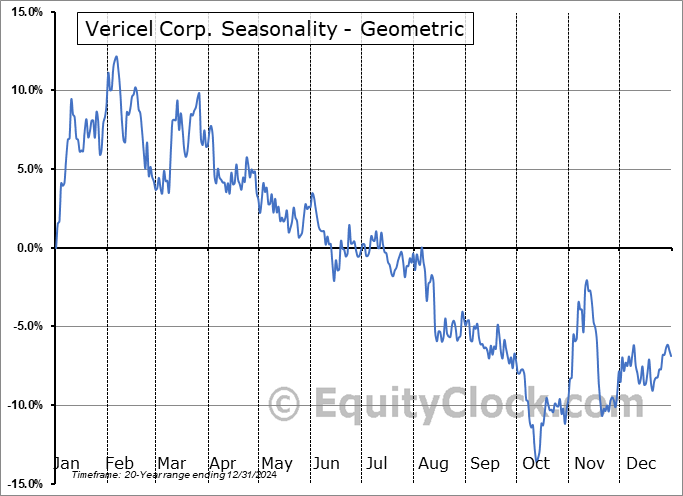

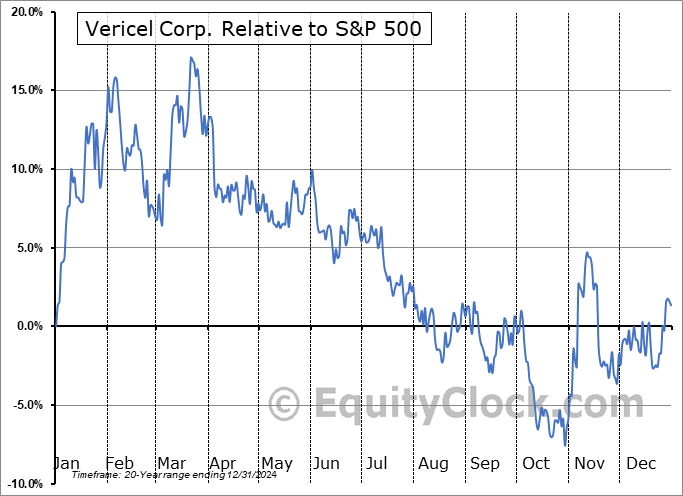

Vericel Corp. (NASD:VCEL) Seasonal Chart

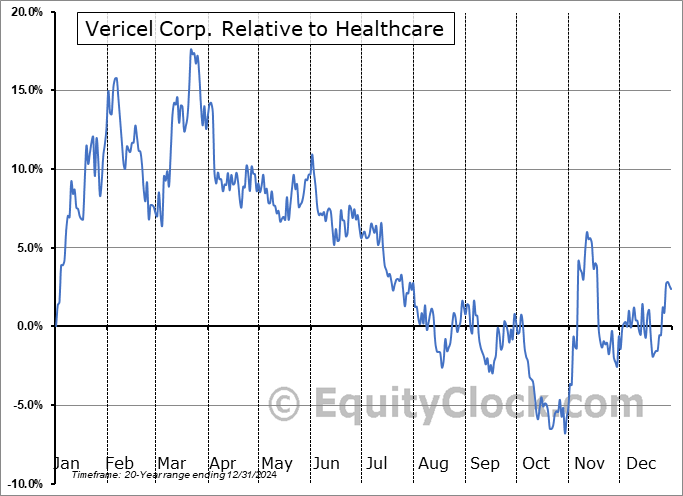

Seasonal Chart Analysis

Analysis of the Vericel Corp. (NASD:VCEL) seasonal charts above shows that a Buy Date of October 16 and a Sell Date of January 9 has resulted in a geometric average return of 5.78% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 13 of those periods. This is a good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 25.18% per year.

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Healthcare sector, which runs from April 25 to December 4. The seasonal chart for the broad sector is available via the following link: Healthcare Sector Seasonal Chart.

Vericel Corp. engages in the research, product development, manufacture, and distribution of patient-specific, expanded cellular therapies for use in the treatment of patients with diseases. Its product portfolio includes MACI and Epicel. The MACI portfolio is FDA-approved product that applies the process of tissue engineering to grow cells on scaffolds using healthy cartilage tissue from the patient’s own knee. The Epicel portfolio provide skin replacement for patients who have deep dermal or full thickness burns. The company was founded on March 24, 1989 and is headquartered in Cambridge, MA.

To download VCEL seasonal chart data, please log in or Subscribe.

To download VCEL seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: VCEL

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|