Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

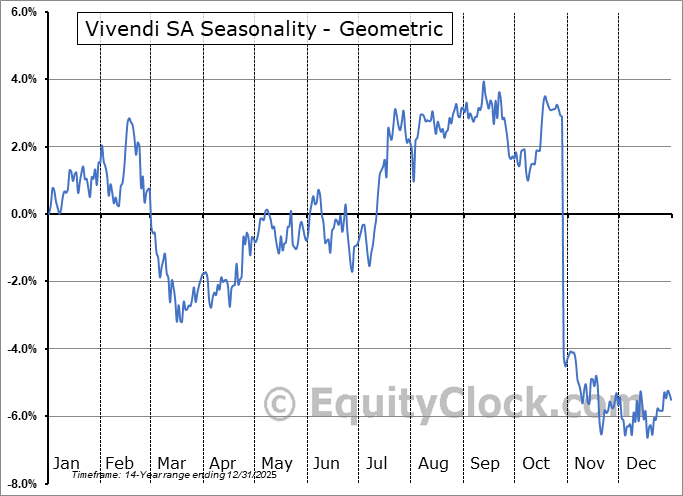

Vivendi SA (OTCMKT:VIVHY) Seasonal Chart

Seasonal Chart Analysis

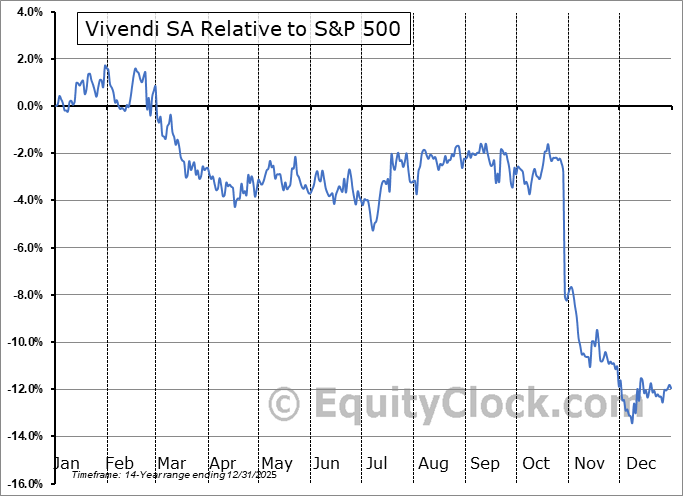

Analysis of the Vivendi SA (OTCMKT:VIVHY) seasonal charts above shows that a Buy Date of July 6 and a Sell Date of September 24 has resulted in a geometric average return of 2.02% above the benchmark rate of the S&P 500 Total Return Index over the past 14 years. This seasonal timeframe has shown positive results compared to the benchmark in 9 of those periods. This is a fair rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 14 years by an average of 19.46% per year.

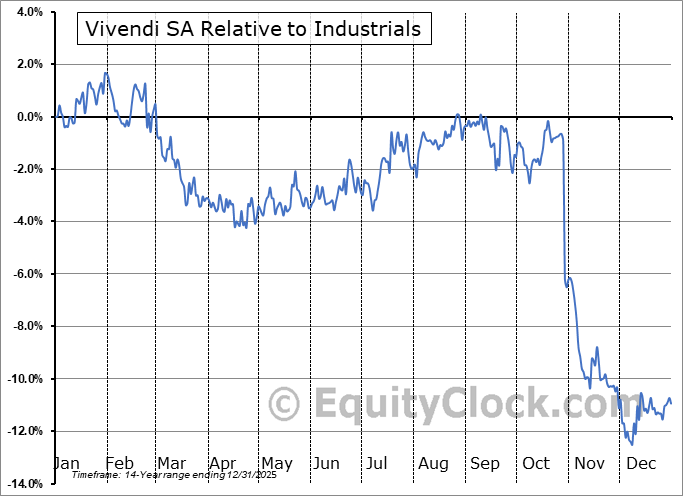

The seasonal timeframe correlates Poorly with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Vivendi SE engages in the provision of media and telecommunications services. It operates through the following segments: Universal Music, Canal+, Havas, Editis, Gameloft, Vivendi Village, New Initiatives, and Corporate. The Universal Music segment includes sale of recorded music (digital and physical), exploitation of music publishing rights, as well as artist services and merchandising. The Canal+ segment involves in publishing and distribution of premium and thematic pay-TV and free-to-air channels in France, Benelux, Poland, Central Europe, Africa and Asia, and production, sales and distribution of movies and TV series. The Havas segment is a communications group spanning all the communications disciplines. The Editis segment encompasses selling and distribution of literature, educational and reference book. The Gameloft segment engages in creation and publishing of downloadable video games for mobile phones, tablets, triple-play boxes and smart TVs. The Vivendi Village segment includes vivendi ticketing and live performances through olympia production, festival production, and the venues in Paris. The New Initiatives segment consists of dailymotion and Group Vivendi Africa. The Corporate segment provides centralized services. The company was founded on December 18, 1987 and is headquartered in Paris, France.

To download VIVHY seasonal chart data, please log in or Subscribe.

To download VIVHY seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: VIVHY

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|