Stocks: Sectors

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financial

- Technology

- Utilities

Futures

Benchmarks

Forex

Industries

Comparative

Seasonal Start

Economic Data

Wolters Kluwers NV (OTCMKT:WTKWY) Seasonal Chart

Seasonal Chart Analysis

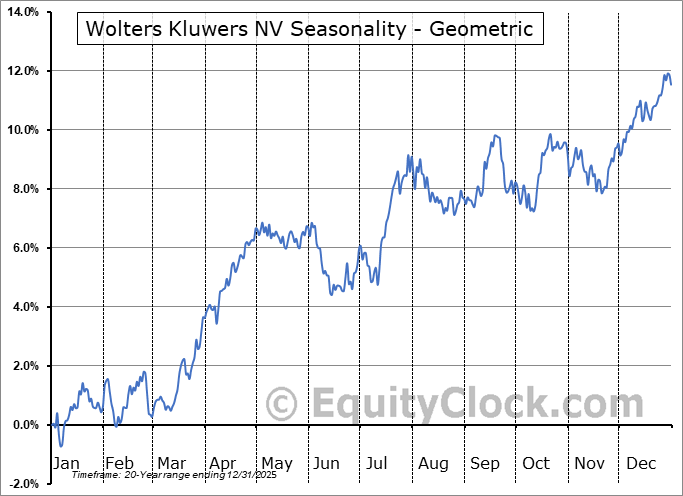

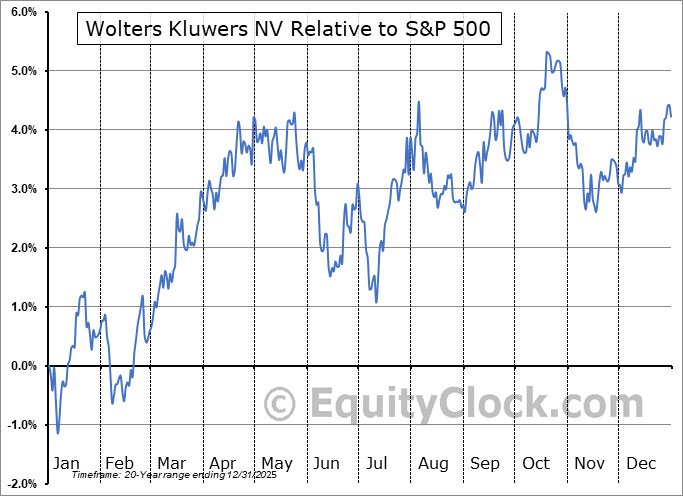

Analysis of the Wolters Kluwers NV (OTCMKT:WTKWY) seasonal charts above shows that a Buy Date of January 6 and a Sell Date of May 21 has resulted in a geometric average return of 4.23% above the benchmark rate of the S&P 500 Total Return Index over the past 20 years. This seasonal timeframe has shown positive results compared to the benchmark in 16 of those periods. This is a very good rate of success and the return strongly outperforms the relative buy-and-hold performance of the stock over the past 20 years by an average of 3.62% per year.

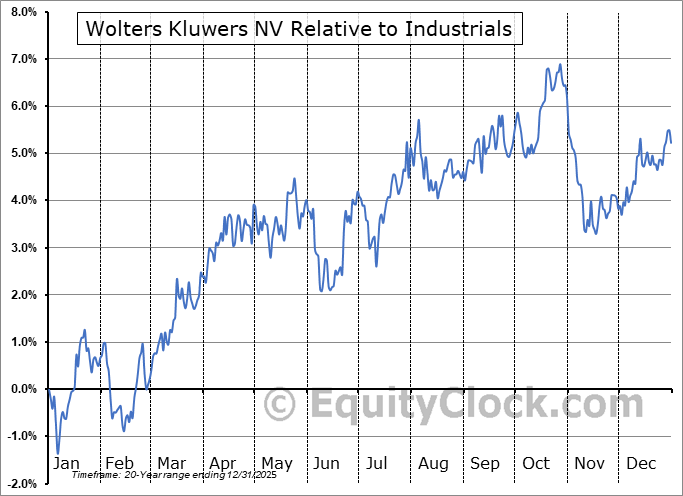

The seasonal timeframe is Inline with the period of seasonal strength for the Industrials sector, which runs from October 29 to May 10. The seasonal chart for the broad sector is available via the following link: Industrials Sector Seasonal Chart.

Wolters Kluwer NV engages in the provision of information, software solutions, and services for professionals in the health, tax and accounting, finance, risk and compliance, and legal sectors. It operates through the following segments: Health; Tax and Accounting; Governance, Risk, and Compliance; and Legal and Regulatory. The Health segment offers evidence based clinical decision support, medical, nursing and allied health content, medical research platform, and nursing practice solutions. The Tax and Accounting segment provides solutions for internal audit, controls, and analytics. The Governance, Risk, and Compliance segment distributes legal compliance services, enterprise-wide legal management, and regulatory and operational compliance solutions that leverage workflow, analytics, and reporting capabilities. The Legal and Regulatory segment develops software, n, analytics,vital information and integrated workflow solutions that help customers streamline complex legal and regulatory compliance requirements. The company was founded by Jan-Berend Wolters and Aebele Everts Kluwer in 1836 and is headquartered in Alphen aan den Rijn, the Netherlands.

To download WTKWY seasonal chart data, please log in or Subscribe.

To download WTKWY seasonal chart data, please log in or Subscribe.

Stocks mentioned in this post: WTKWY

Symbols by Letter: A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z

|

|