Looking out for the cues that would suggest selling exhaustion in order to flip back to risk-on in the equity market.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

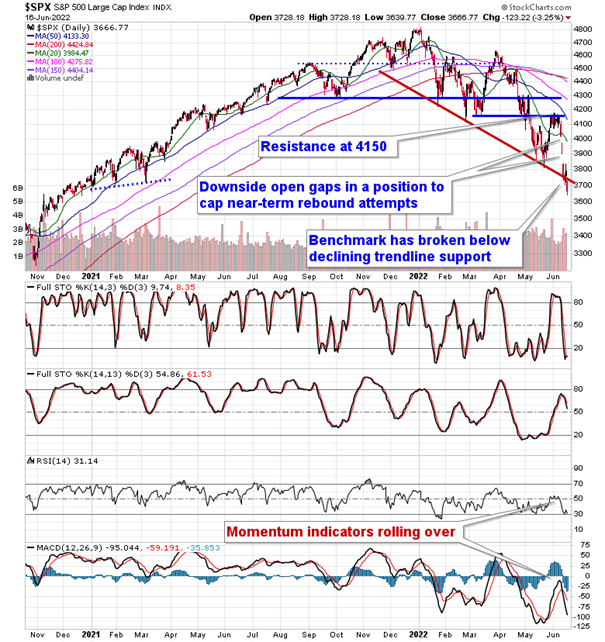

Stocks took another leg lower on Thursday as a slew of negative economic data-points and ongoing reaction to the FOMC announcement on Wednesday had investors looking to shed further risk in portfolios. The S&P 500 Index dropped by 3.25%, breaking below declining trendline support that had been keeping the selloff orderly since the year began. Traditionally, the market moving from an orderly to disorderly decline as investors seek to aggressively get out of positions typically marks the beginning of the end to declining trends. Momentum indicators are reaching back towards oversold extremes with the Relative Strength Index on the verge of crossing below the 30-threshold that acts as the borderline for declaring an oversold state. It was the riskiest segment of the market that fuelled the decline with the consumer discretionary and energy sectors down around 5% on the day while the more defensive consumer staples sector was just marginally lower. Risk aversion is implied, however, for those that have staked their claim in some of the more defensive segments of the market are not feeling much comfort given the breakdown in many lower-beta bets (staples, utilities, REITs) in recent days. The price action resembles an investor base that just wants out, but this flood of selling is more likely to lead to a tradable low in stocks as downside exhaustion becomes realized. We are not there yet, but getting close.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

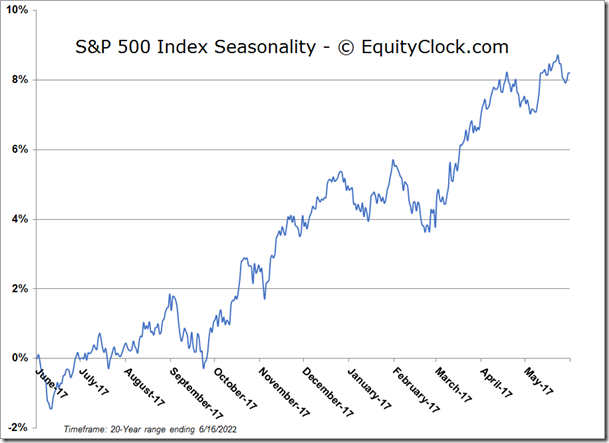

S&P 500 Index

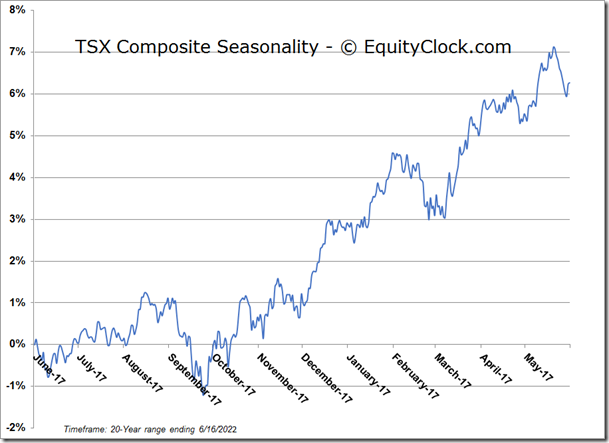

TSE Composite