US Dollar Index rolling over from the upper limit of its rising trend channel, providing relief to the downward trajectory of stocks.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

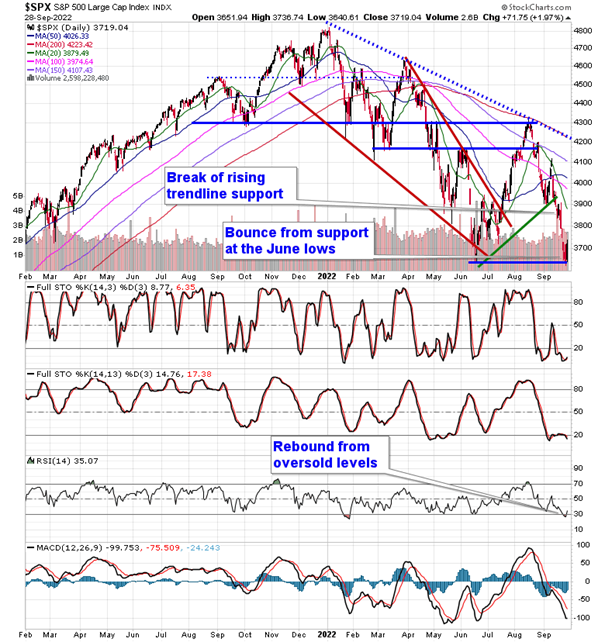

A sharp reversal in yields and the dollar helped to pick stocks up from the lows of the year on Wednesday as the Bank of England interjected in the bond market to add some stability to what had become a fragile tape. The S&P 500 Index surged higher by around 2%, bouncing firmly from levels around the June lows and moving back towards one of a few downside open gaps that have been charted over the past few weeks amidst inflation/rate fears. The first gap can be seen around 3745, representing Friday’s downside open. The more threatening gap can be seen just below the September highs around the now declining 50-day moving average at 4026. So long as major moving averages continue to point lower, using the hurdles as resistance to sell into is the appropriate course of action. The declining 20-day moving average can be seen at 3879. While the bounce from the June lows is a welcome relief, hinting of a double bottom, we would have to view the apparent point of support as part of a lower bound of a range that the market may find itself in through the end of the year. We have had to dampen our enthusiasm towards our forecasted back half of the year rebound in the market given the degradation in the technicals and the shift in the goal posts presented by the Fed’s year-end target for the key lending rate, however, we still foresee the typical November/December strength before another sustained downleg in stocks potentially appears in the new year, assuming the fundamental backdrop in the economy does not improve materially by then.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

Seasonal charts of companies reporting earnings today:

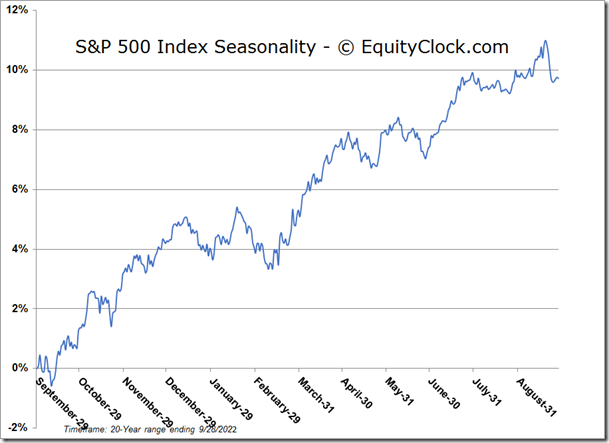

S&P 500 Index

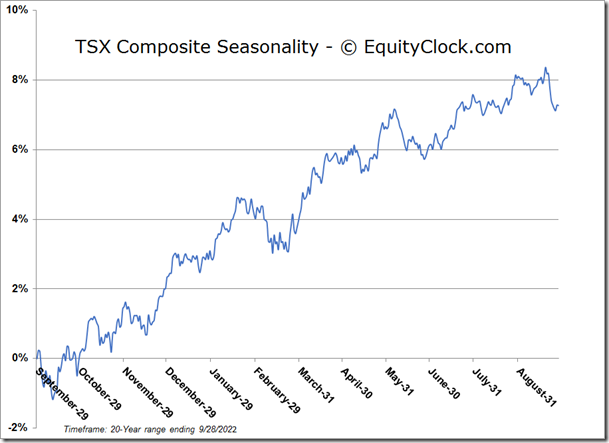

TSE Composite