Many constituents in the Dow Jones Industrial Average are showing highly enticing double-bottom patterns around the summer lows.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

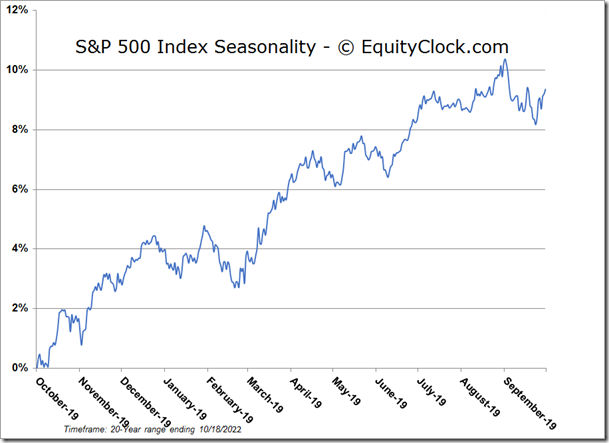

Stocks closed mildly higher on Tuesday as the market continues to square away negative bets within portfolios amidst the start of the third quarter earnings season. The S&P 500 Index gained just over one percent, closing above its 20-day moving average for the first time since August. An upside gap charted after the open at 3700 was quickly filled, but indications of support at this short-term hurdle remain. Momentum indicators continues to push higher, keeping positive divergences compared to price intact and signalling waning selling pressures around what has been a highly pivotal level at the June low of 3636. The next hurdle beyond now broken resistance at the 20-day moving average is the 50-day, now at 3915, presenting the logical level to test on this rebound attempt. However, so long as major moving averages, such as the 50-day, are pointed lower, using the barrier as a level to sell into in order to lighten up on equity exposure is seen as appropriate until the trajectory of the paths shift back positive.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

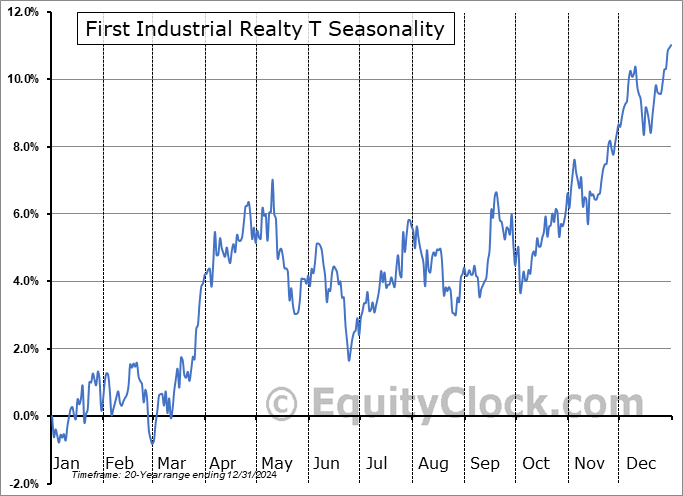

Seasonal charts of companies reporting earnings today:

S&P 500 Index

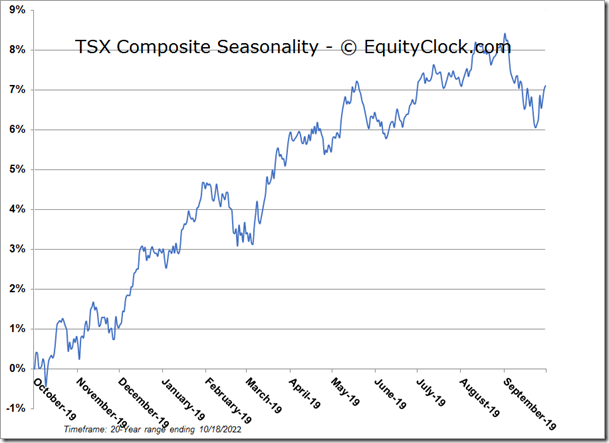

TSE Composite