The return of the meme-stock craze has started to create some euphoria in the market, which is certainly not a bad thing, yet.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

Stocks rallied on Tuesday as traders shook off of a hotter than expected read of inflationary pressures for April and focused on the rebirth of the meme-stock craze. The S&P 500 Index added around half of one percent, knocking on the door of the all-time high that was charted at the end of March around 5264. The rising intermediate-term trend of the benchmark remains well intact, supported by the 100-day moving average, now at 5020. The 20-day moving average is back on the rise, adding a positive bias back to the short-term trend of stocks as we progress further into the off-season for this asset class that began just over a week ago. Until this market shows greater evidence of resistance than support, reason to maintain a bullish bias of stocks exists. particularly in those groups that we have been advocating to Accumulate in our weekly chart books (see our list of market segments to Accumulate or to Avoid).

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

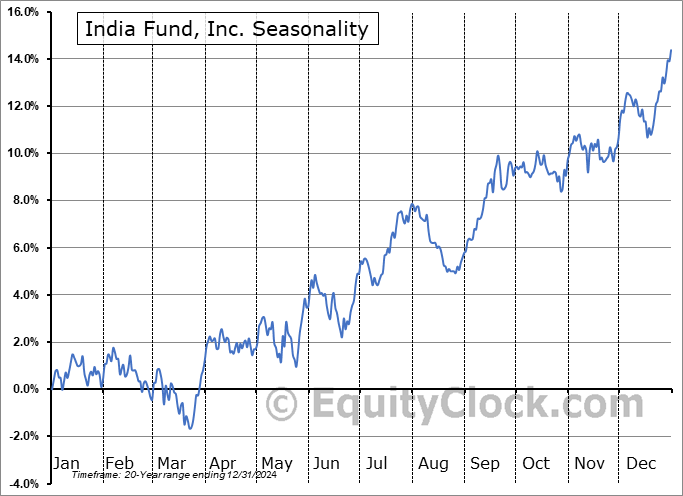

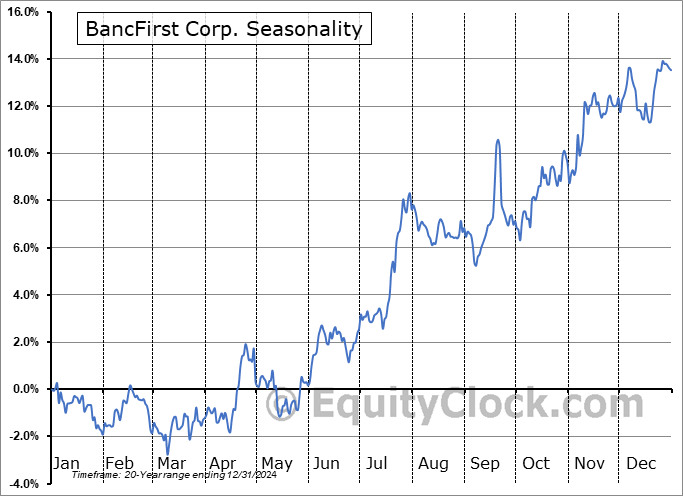

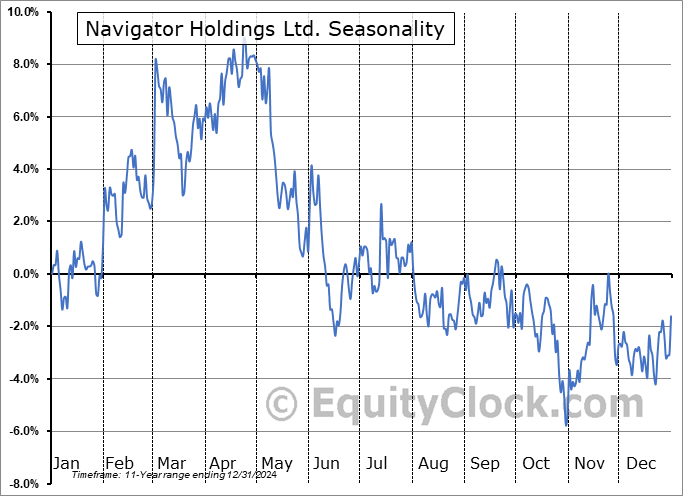

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite