Durable goods orders showed a significant plunge in July, but there are still segments in the manufacturing economy to be invested in.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Super Simple Seasonal Portfolio

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

The Markets

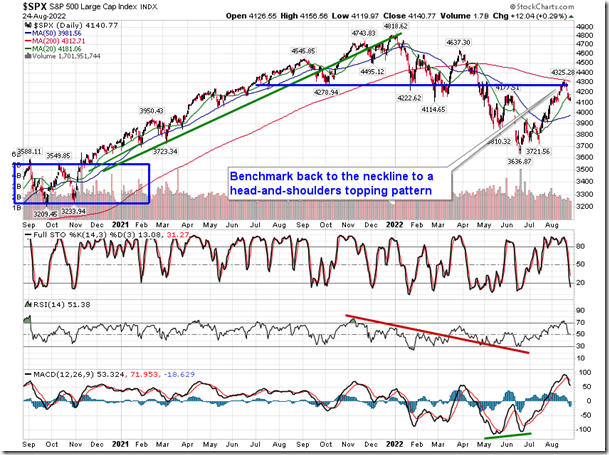

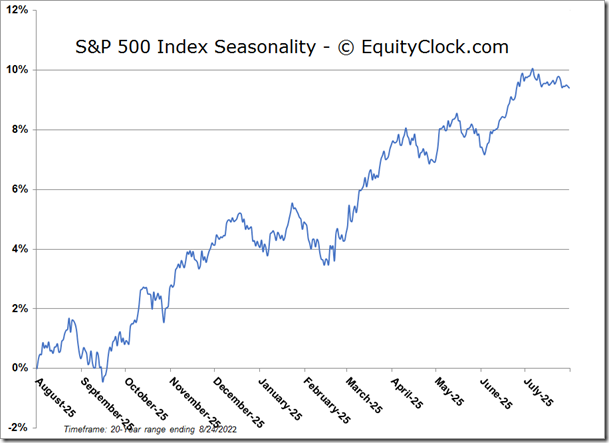

Stocks ticked higher on Wednesday, providing a bit of a reprieve to the selling pressures that were realized to start the week. The S&P 500 Index closed higher by just less than three-tenths of one percent, once again taking a swing at horizontal resistance near 4170. The relative strength index (RSI) is back hovering around its middle line after falling from significantly overbought levels recorded through the middle of the month and progress is being made to flip the script away from the bearish path that dominated through the first half of the year. Typically, following an overbought rally, the market does not immediately revert back to a bearish path without some catalyst to bring upon an abrupt shift. Still, further consolidation of the strength that has been realized since the lows of the market in June is seen as likely before a rising intermediate trend is solidified, ideally around the now rising 50-day moving average at 3981. Gap resistance between 4195 and 4218 is seen as the near-term cap. This is the most volatile time of the year for stocks, so we are always on the lookout for shenanigans in this low volume summer trade, but there is still sufficient evidence to suggest that the June bottom was the low for this year and that the intermediate trend of stocks has shifted.

This content is exclusive to subscribers of EquityClock.com. Please Log In or Subscribe to proceed.

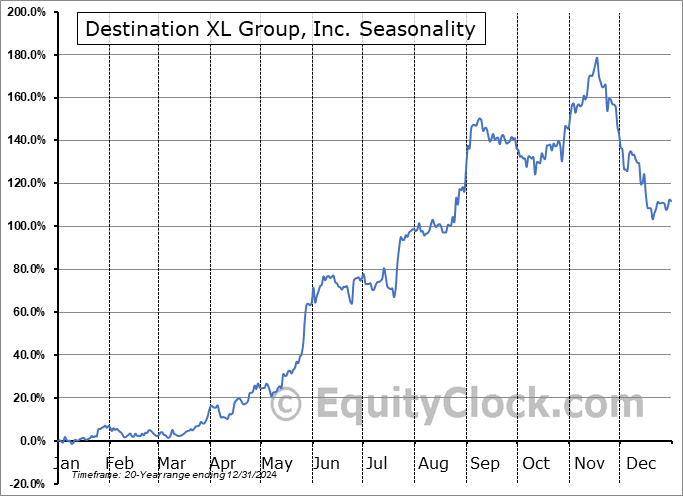

Seasonal charts of companies reporting earnings today:

S&P 500 Index

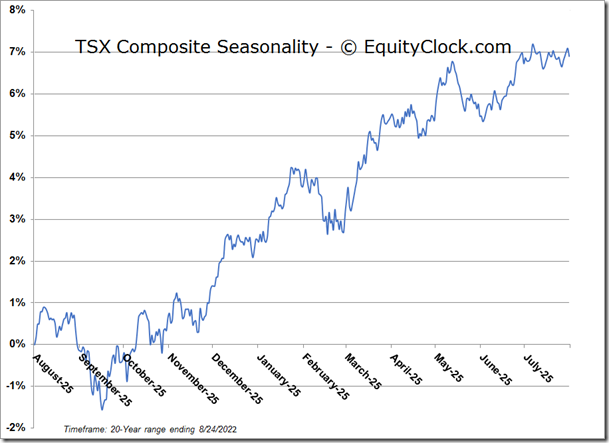

TSE Composite